US-India Investment Fund

- Home

- US-India investment fund

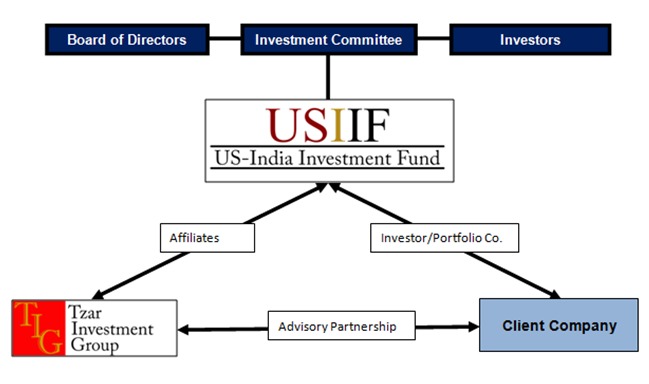

Tzar Investment Group can aid client companies to acquire capital from numerous sources, from capital markets to strategic partners. Due to the growing demand for capital investments in Tzar and its client company’s engagements, Tzar’s partners founded a private equity fund US-India Investment Fund LP (USIIF). USIIF will make later stage growth capital investments into companies in either the US or India, which has an appetite to do business between the two countries. Prior to making an investment, a company must engage Tzar Investment Group to perform the complete due diligence and structure the investment. Once a structure and business plan has been formulated, Tzar will propose the investment to USIIF’s investment committee, which needs a majority vote to make a capital investment. If the project does not meet USIIF’s investment criteria, Tzar may continue to promote the company and seek investment from external investors.

Tzar and USIIF have cultivated a philosophy of creating long-term strategic equity partnerships with target companies and management teams. This provides Tzar and USIIFa platform to help portfolio companies explore strong business synergies through its global network of expertise in various industries. Tzar and USIIF are jointly committed to achieving superior, long-term returns on investment for its partner companies and investors